Welcome, fellow crypto enthusiasts! Are you ready to dive into the exciting world of crypto mining and discover the untapped potential for maximizing your profits? Look no further, as this blog post will unveil valuable tips and tricks to help you achieve success in your crypto mining endeavors. Whether you’re a beginner seeking guidance or an experienced miner looking to enhance your earnings, this comprehensive guide has got you covered. So, grab your mining gear, buckle up, and let’s embark on a thrilling journey towards financial gains in the realm of cryptocurrency!

Understanding Crypto Mining

What is Crypto Mining?

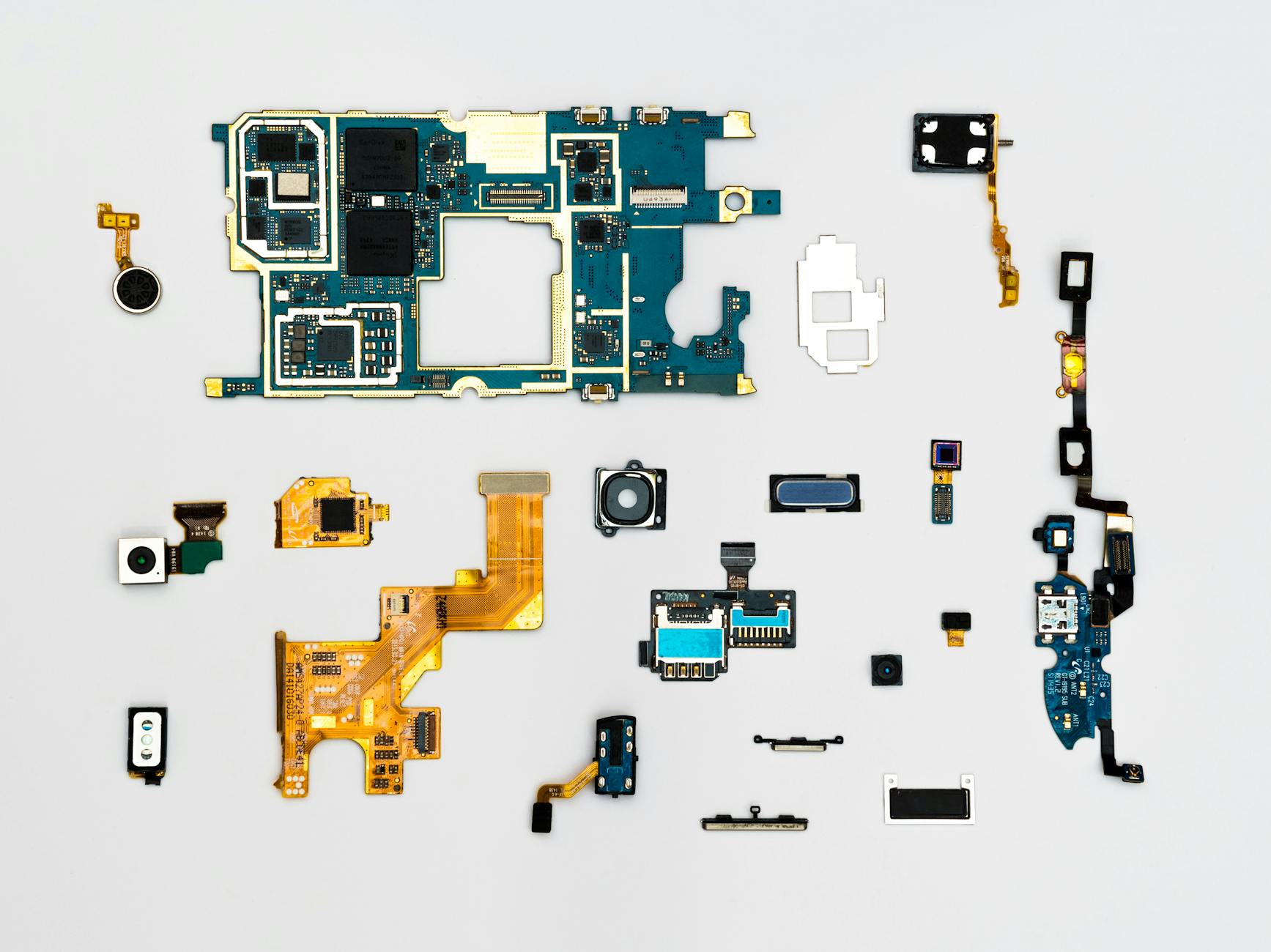

Blue and Yellow Phone Modules (Photo by Dan Cristian Pădureț)

Blue and Yellow Phone Modules (Photo by Dan Cristian Pădureț)

Crypto mining is the process of validating and verifying transactions on a blockchain network, such as Bitcoin or Ethereum, in exchange for new coins. It is a crucial component of the cryptocurrency ecosystem, as it ensures the security and integrity of the network.

In simpler terms, crypto mining is like solving complex mathematical puzzles to confirm and add transactions to the blockchain. Miners compete with each other to be the first to solve these puzzles, and the one who succeeds is rewarded with a certain amount of cryptocurrency.

How Does Crypto Mining Work?

Aerial Photography of Field (Photo by Tom Fisk)

Aerial Photography of Field (Photo by Tom Fisk)

Crypto mining works through a consensus mechanism called Proof of Work (PoW). Here’s a simplified breakdown of the process:

- Transaction validation: When someone initiates a transaction, it gets broadcasted to the network. Miners collect these transactions and bundle them into blocks.

- Solving the puzzle: Miners use powerful hardware, known as mining rigs, to perform numerous calculations in an attempt to find a specific solution to the cryptographic puzzle. This requires substantial computational power and energy consumption.

- Finding the nonce: Miners adjust a value called a nonce in their calculations, searching for the one that, when combined with the block data, produces a hash with specific characteristics. It’s like searching for a needle in a haystack, but with the help of advanced computing power.

- Adding the block: The first miner to find the correct nonce broadcasts it to the network, along with the block of transactions. Other miners then verify the solution and add this new block to the blockchain.

- Reward: The miner who successfully adds the block is rewarded with new coins, typically in the form of the cryptocurrency being mined. This incentivizes miners to continue their efforts and maintain the security of the network.

- Difficulty adjustment: As more miners join the network, the difficulty of the puzzles automatically adjusts to ensure that new blocks are added at a consistent rate. This mechanism prevents the network from being flooded with blocks or experiencing significant delays.

It’s important to note that not all cryptocurrencies use PoW; some employ alternative consensus mechanisms like Proof of Stake (PoS) or Delegated Proof of Stake (DPoS). These mechanisms differ in their approach to validating transactions and distributing rewards.

Overall, crypto mining is a complex yet fascinating process that powers the decentralized nature of cryptocurrencies. By understanding how it works, you can gain insights into the mechanics behind this innovative technology.

Note: The image placeholders provided are symbolic and are not actual representations of crypto mining setups or illustrations. Please use relevant and authentic images when including visuals in your blog post.

Choosing the Right Cryptocurrency to Mine

Now that you’ve decided to venture into the world of crypto mining, it’s crucial to choose the right cryptocurrency to maximize your profits. In this section, we will explore two key factors to consider when selecting the most lucrative crypto to mine: researching profitability and evaluating market demand.

Researching Profitability

Before diving into crypto mining, it’s essential to research and assess the profitability of different cryptocurrencies. Here are a few strategies to help you make an informed decision:

- Analyze Mining Rewards: Look into the block rewards and mining difficulty of various cryptocurrencies. Higher block rewards and lower mining difficulty can potentially lead to more significant profits.

- Study Historical Data: Examine the historical price trends and evaluate the potential for future growth in the value of different cryptocurrencies. Consider factors such as market volatility, inflation rates, and technological advancements that could impact profitability.

- Consider Energy Consumption: Take into account the energy consumption involved in mining different cryptocurrencies. Some coins require significantly more energy to mine than others, impacting your bottom line. Opting for energy-efficient cryptocurrencies can help increase your profitability.

Evaluating Market Demand

Apart from profitability, it’s crucial to evaluate the market demand for the cryptocurrency you intend to mine. Here are a few factors to consider:

- Assess User Adoption: Look for cryptocurrencies that have a strong user base and growing adoption in various industries. A cryptocurrency with a larger user base is likely to have higher liquidity and demand, increasing its potential for profitable mining.

- Stay Up-to-Date with Trends: Keep an eye on the latest industry news and trends. Look for cryptocurrencies that are gaining traction due to technological advancements or partnerships with influential companies. Being aware of emerging trends can help you align your mining efforts with potentially lucrative opportunities.

- Consider Long-Term Viability: Evaluate the long-term viability of the cryptocurrency you plan to mine. Look for projects with a solid development team, a clear roadmap, and a strong community. These factors contribute to the stability and sustainability of the coin, ensuring continued demand in the future.

By thoroughly researching profitability and evaluating market demand, you can make an informed decision when choosing which cryptocurrency to mine. Remember to regularly reassess your mining strategy as the landscape evolves to ensure you stay ahead and maximize your profits.

A Bitcoin and Smartphone on a Black Surface (Photo by Leeloo Thefirst)

A Bitcoin and Smartphone on a Black Surface (Photo by Leeloo Thefirst)

Stay tuned for the next section, where we will discuss the essential hardware and software requirements for successful crypto mining.

Setting Up Your Mining Rig

In the world of crypto mining, setting up your mining rig is the crucial first step towards maximizing your profits. In this section, we will dive into two important aspects: selecting the right hardware and installing and configuring the necessary software. So, let’s get started!

Selecting the Right Hardware

When it comes to crypto mining, the hardware you choose plays a significant role in your success. Here are a few key factors to consider when selecting the right hardware for your mining rig:

- Processing Power: Look for high-performance GPUs (Graphics Processing Units) specifically designed for mining. These GPUs offer better hash rates and energy efficiency, allowing you to mine more efficiently.

- Memory: Opt for mining rigs with ample memory, as it allows for faster data processing and enhances mining performance.

- Energy Efficiency: Energy consumption directly impacts your profitability. Choose hardware that offers a good balance between hash power and energy efficiency, as it will keep your electricity costs in check.

- Cooling Mechanisms: Efficient cooling is crucial to prevent overheating and ensure stable mining operations. Consider investing in cooling solutions like fans or specialized mining cases with built-in cooling systems.

Remember, the hardware market is constantly evolving, so staying updated with the latest trends and technologies will give you a competitive edge in the mining landscape.

Installing and Configuring Software

Once you have your hardware ready, it’s time to install and configure the necessary software to start mining. Here’s a step-by-step guide to get you up and running:

- Choose a Mining Software: Select a mining software that is compatible with your chosen cryptocurrency. Popular options include CGMiner, EasyMiner, and Claymore’s Miner. Each software has its own features and configuration settings, so do some research to find one that suits your needs.

- Create a Wallet: Before you can start mining, you’ll need a cryptocurrency wallet to securely store your earnings. Choose a reputable wallet provider and follow the instructions to set up your wallet.

- Join a Mining Pool: Joining a mining pool allows you to combine your hashing power with other miners, increasing your chances of earning rewards. Research and choose a reliable mining pool that offers low fees and has a good track record.

- Configure the Software: Once you have chosen the software, follow the installation instructions provided by the software developer. Configure the software by entering your mining pool details and wallet address. Each software has its own configuration process, so consult the documentation or online tutorials for specific guidance.

- Start Mining: After configuring the software, you’re ready to start mining! Launch the mining software and monitor your mining rig’s performance through the software’s user interface. Keep an eye on metrics like hash rate, temperature, and accepted shares to ensure smooth and efficient mining operations.

Remember, mining can put a strain on your hardware, so regular maintenance and monitoring are essential to maximize your profits and prolong the lifespan of your equipment.

Now that you have set up your mining rig, it’s time to dive into optimizing your mining operations to further enhance your profitability. Stay tuned for the next section where we will explore tips and tricks to fine-tune your mining setup.

Black and Gray Tub Chairs (Photo by Pixabay)

Black and Gray Tub Chairs (Photo by Pixabay)

Joining a Mining Pool

Benefits of Mining Pools

Mining cryptocurrencies can be a challenging task, especially in the highly competitive market of crypto mining. One strategy to maximize your profits and increase your chances of success is to join a mining pool. Mining pools are groups of miners who combine their computing power to solve complex mathematical equations required for mining cryptocurrencies. Here are some key benefits of joining a mining pool:

- Increased Mining Efficiency: By pooling resources together, mining pools can achieve higher computational power, increasing the chances of successfully mining blocks and earning rewards. This reduces the time it takes to mine new coins and helps ensure a steady revenue stream.

- Steady and Predictable Income: Mining pools distribute the rewards earned among its members based on their contributed computing power. Joining a mining pool allows you to receive a more consistent income rather than relying on the luck of solo mining. This steady income can provide you with a sense of stability and enable you to plan your investment strategies more effectively.

- Access to Advanced Mining Equipment: Mining pools often have access to high-end mining equipment and technology, which may be otherwise expensive or difficult for individual miners to acquire. This access to better hardware can significantly enhance your mining capabilities and increase the chances of earning higher profits.

- Learning and Support: Joining a mining pool provides an opportunity to learn from experienced miners who are part of the pool community. This shared knowledge and support network can be valuable, especially for beginners who are still learning the intricacies of crypto mining. You can gain insights, tips, and tricks from seasoned miners to improve your mining efficiency and profitability.

Women at the Meeting (Photo by RF._.studio)

Women at the Meeting (Photo by RF._.studio)

How to Choose a Mining Pool

Choosing the right mining pool is crucial for maximizing your profits and ensuring a smooth mining experience. Here are some factors to consider when selecting a mining pool:

- Reputation and Reliability: Research the reputation and track record of the mining pool before joining. Look for pools that have been operating for a considerable period, have positive user reviews, and are known for their reliability and fair distribution of rewards.

- Pool Size and Hashrate: Consider the size of the mining pool and its total hashrate. A larger pool generally implies more computational power, resulting in more frequent blocks being solved. However, smaller pools can also offer advantages, such as reduced competition for rewards. Choose a pool size and hashrate that aligns with your mining goals and preferences.

- Reward Distribution Method: Different mining pools adopt various reward distribution methods, such as Pay-Per-Share (PPS), Proportional, or Pay-Per-Last-N-Shares (PPLNS). Each method has its own advantages and disadvantages in terms of payout frequency and risks. Research and understand the reward distribution mechanism employed by a pool to ensure it suits your mining style and objectives.

- Fees and Payment Threshold: Mining pools usually charge a fee for their services, which is typically a percentage of the rewards earned. Compare the fee structures of different pools and consider the impact of these fees on your overall profitability. Additionally, check the payment threshold of the pool to ensure it aligns with your desired frequency of receiving payouts.

- User Interface and Features: Evaluate the user interface and features offered by the mining pool’s website or mining software. A user-friendly interface, detailed statistics, real-time monitoring, and additional tools can greatly enhance your mining experience and allow you to track your performance more effectively.

By carefully considering these factors and finding a mining pool that suits your needs, you can enhance your chances of success and maximize your profits in the world of crypto mining.

Remember, mining pools are not a guarantee of profits, but they provide a collaborative environment and increased efficiency that can significantly improve your mining outcomes.

Conclusion

In conclusion, maximizing your profits in the world of crypto mining requires a combination of knowledge, strategy, and adaptability. By following the tips and tricks discussed in this blog post, you can enhance your chances of success and make the most out of your mining endeavors.

First and foremost, it’s essential to choose the right cryptocurrency to mine. Conduct thorough research to identify coins that present favorable mining conditions and have the potential for future growth. Additionally, make sure to stay updated with the latest trends and developments in the crypto market to capitalize on emerging opportunities.

Efficiency is key when it comes to crypto mining. Optimize your mining rig by selecting the right hardware, setting up a cooling system, and ensuring efficient power consumption. Regularly monitor and fine-tune your mining operation to maximize your hash rate and minimize downtime.

Diversification is another crucial aspect of profitable crypto mining. Instead of solely focusing on one cryptocurrency, consider mining multiple coins to spread your risk and increase your chances of finding lucrative blocks. This approach can help mitigate the impact of market volatility and fluctuations in mining difficulty.

Lastly, stay informed about the ever-evolving regulatory landscape surrounding cryptocurrencies. Compliance with local regulations is essential to ensure the legality and sustainability of your mining activities. Stay ahead of any changes in regulations to avoid potential disruptions and legal complications.

Remember, successful crypto mining is a continuous learning process. Stay curious, explore new strategies, and adapt to market conditions. By implementing these tips and tricks, you can maximize your profits and thrive in the dynamic world of crypto mining.